Besides nature, cuisine, and climate, Georgia is also one of the fastest growing economies: in 2024, GDP will grow by 7.6%, or sixth globally, according to the IMF (3.2% is the global average). In terms of the broader trends, real GDP grew by 44% from 2021 to 2024, with nominal GDP growing by 82%.

Other reasons Georgia attracts foreign investors:

- High return on investment. Low competition and growing demand have meant potential returns on investments in real estate, securities, and tourism are higher than in developed markets (think US and EU)

- A low corporate tax burden. Corporate income tax has to be paid only when dividends are distributed, but even this can be avoided by using special tax regimes for IT companies or participation in industrial zones

- Low individual taxes. Income from renting out real estate is taxed at a rate of 5%. The same rate applies to interest income and dividends, and there is no tax at all on securities (under certain conditions)

- A residence permit for investment for a period of five years with a purchase of real estate with a market value of USD 300,000 or more (or participating in a business for the same amount). After five years, this residence permit can be converted into a permanent residence permit

- Tax residency under the High Net Worth Individual program. We’ll talk about this separately

Benefits of the High Net Worth Individual program

The High Net Worth Individual program grants tax residency without requiring that a person actually spend 183 days in the country each year. One of the main conditions of the program is an investment in the Georgian economy of at least USD 500,000. Read more about the program in this article. Here we will provide a brief list of the advantages of Georgian residency:

- You don’t have to pay tax on foreign income

- Profit from the sale of cryptocurrency is also not taxable (it is considered foreign income)

- One of the most attractive rates in the world applies to local income. For example, individual entrepreneurs with small business status pay the incredibly low rate of 1%

- Easier access to the Georgian banking system, which treats you like a local resident with less stringent KYC procedures

The big question is where to invest $500K

Residential real estate

Residential real estate has always been one of the most popular investments. Foreign nationals accounted for 24% of apartment and house purchases in Tbilisi in 2024, with Galt & Taggart statistics showing non-residents to have purchased 88% in the country’s second city Batumi.

Of course, an investment of this kind generates income from long-term or short-term rentals with potential for earnings on the growth of the price per square meter.

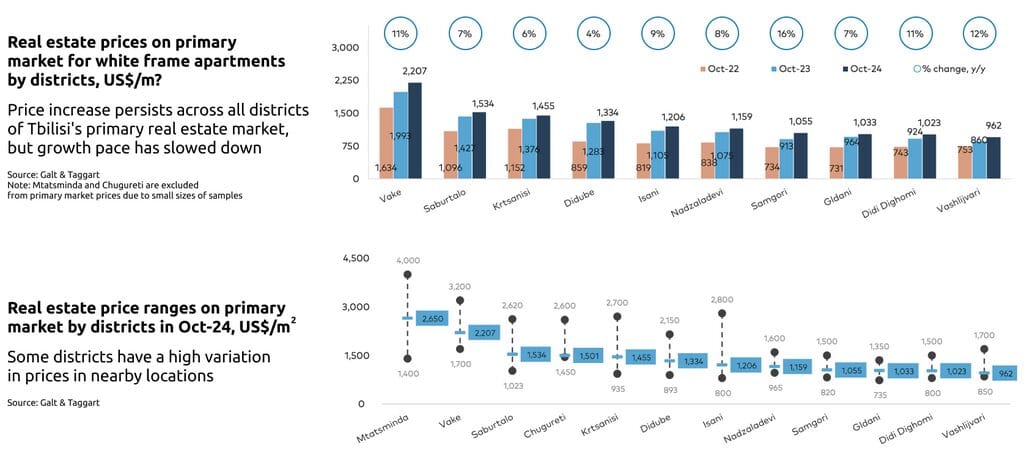

- Prices in Tbilisi start at around USD 900 per square meter in areas a little further out, with the center reaching USD 4,000 or higher. The average price is about USD 1,300 per square meter.

- In Batumi, the average price is slightly higher – USD 1,400 per square meter – though the general range is about the same.

With USD 500,000, you could buy several apartments. In the PB Property catalog, for example, you can find property in Tbilisi’s popular Saburtalo district for USD 145,000 or an apartment in Boulevard Point on the Black Sea coast for USD 45,000.

All properties can be purchased remotely and managed by our team. To find out more, book a free 30-minute consultation.

Rental yields in 2024 in both Tbilisi and Batumi are 9% per annum, while property values have increased at double-digit rates to 16% in many neighborhoods over the past 12 months. Before investing, read a detailed description of Tbilisi neighborhoods.

Commercial real estate

Investors may also wish to consider office or retail space or warehouses as Georgia’s role as a logistics hub increases. The commercial real estate market in the country is expected to grow to USD 34.3 billion in 2025 and USD 42.6 billion in 2029.

The entry threshold here is almost twice as high. For example, office space costs about USD 2,500/square meter and retail space USD 2,000/square meter in the central district of Mtatsminda. Commercial real estate is also more profitable, though, and rentals can bring in 12% or more.

Business, including tourism

Georgia ranks 9th for the speed with which a business can be opened. Register a company in one working day, and if you have a power of attorney, do it remotely. This is certainly one reason foreign nationals have chosen to open almost 43,000 companies and sole proprietorships in Georgia.

Possibly the most promising industry of all is tourism, with cafes, restaurants, tour operators, companies organizing gastronomic, to name a few, cashing in on an audience that continues to grow: from January to September 2024, almost 5.8 million foreign travelers visited Georgia, 4.1% more than for the same period in 2023.

But tourism isn’t the only horse in town. A technology startup, the service sector (beauty salons to medical centers) or trade and production of goods are also worth considering.

Or how about buying a franchise? USD 500,000 should be enough to open a Carrefour, and Carrefour is looking for franchisees in Georgia. Or Spar and delivery operator CDEK, which claims a payback period of up to 10 months.

Financial instruments: deposits and bonds

Bank deposits are the easiest way to place money in Georgia. Just open an account in one of the country’s largest banks – TBC, Bank of Georgia (or Solo, which is a premium subsidiary of BoG) – in lari, dollars, euros, or pounds sterling. The yield depends on the bank but can reach 10% per annum in Georgian lari (does not exceed 1.5% in dollars).

If you are looking for high-yield hard currency with a comfortable level of risk, look no further than a brokerage account with TBC Capital or Galt & Taggart and gain access to the bonds of Georgian companies. Recent issues have offered coupon rates of up to 8.75% in USD and up to 7.75% in EUR. As of now, bonds in Georgian lari yield up to 12% per annum.

With brokers come access to foreign stock exchanges: USA, UK, Europe, and Hong Kong, among others. PB Services can help you open a bank and brokerage account quickly and cut through the red tape – learn more about the service here or enjoy a free 30-minute consultation.

Cryptocurrency is for the risk tolerant

Georgia ranks fourth in the Forex ranking of the most crypto-liberal countries and ninth among the bitcoin-friendly, no doubt for one of the reasons we’ve already mentioned: Crypto transactions are not taxable for tax residents.

Investments in cryptocurrency can also be counted under the High Net Worth Individual program (and you can buy real estate with cryptocurrency).

In addition to trading and staking cryptocurrency, where there are no limits on profitability in general, you could open an official cryptocurrency business (an exchange or investment platform, for example). To do so, you will need to obtain virtual asset service provider status, or in other words, you’ll need a cryptolicense, something PB Services can help you with.

Mining is also a good option in mountain regions where the cost of electricity is low.

How to choose your best investment option

First you need to identify your target and then do a market analysis. Some thoughts:

- If you’re looking to invest some funds quickly and forget about it for a while – consider government bonds and bank deposits

- If tangible assets are important – think real estate investment

- If you want to take an active part in financial management, you probably want your own business

- If you’re not afraid to take risks – consider stocks, cryptocurrency, and startups

To make an informed choice, contact PB Services for advice. We will carefully consider your case, provide in-depth market analysis, and help you choose an asset that 100% meets your objectives, and we can solve any issues that arise along the way, from registration to residence permit and tax residency.