According to the National Statistics Service (Geostat), there were more than 270,000 active businesses registered in Georgia as of October 1, 2024, and almost 16% were owned by foreigners. Most of those are likely IE with small business status paying only 1% on turnover.

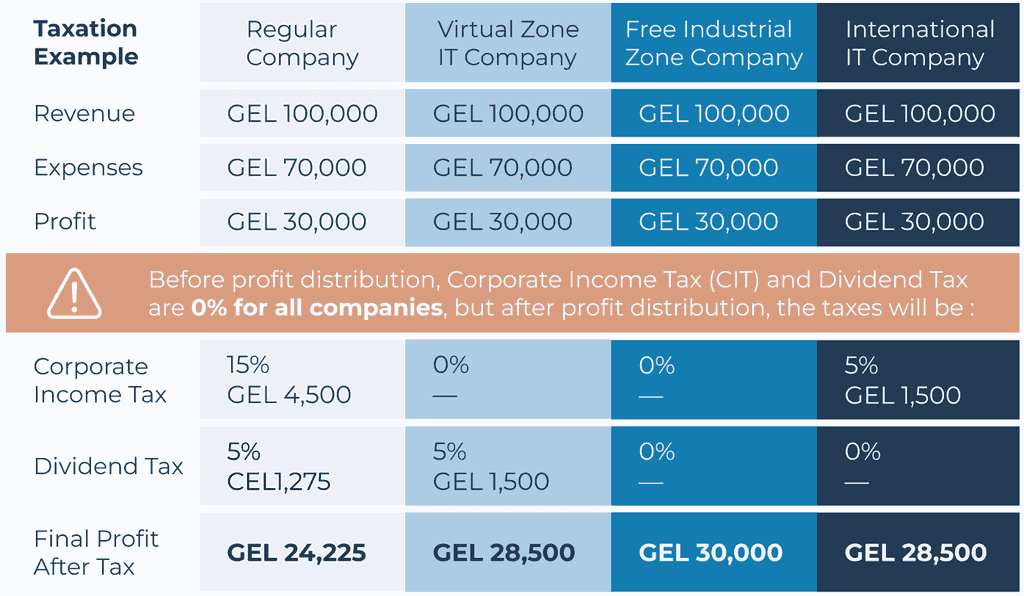

As for larger companies and startups – we wrote previously about the legal forms of limited liability companies (LLC), jointly and severally liable companies (JLC), and joint stock companies (JSC), as well as limited liability companies and cooperatives (a less common choice). The tax burden in Georgia is relatively low for all – the country levies some of the lowest taxes in the world, and sometimes none at all (!).

Taxes in Georgia

There are six major taxes in the country, all of which are listed in Article Six of the Tax Code of Georgia, and all of which relate to business in one way or another:

- Corporate Income Tax (CIT) – 15% (20% for banks, microfinance, and a number of other organizations)

- Income tax, aka Personal Income Tax (PIT) – 20%, withheld by the company from employee salary along with mandatory contributions to the pension fund (more on this later)

- Dividend Tax (a special case of income tax) – 5%, also withheld at the source

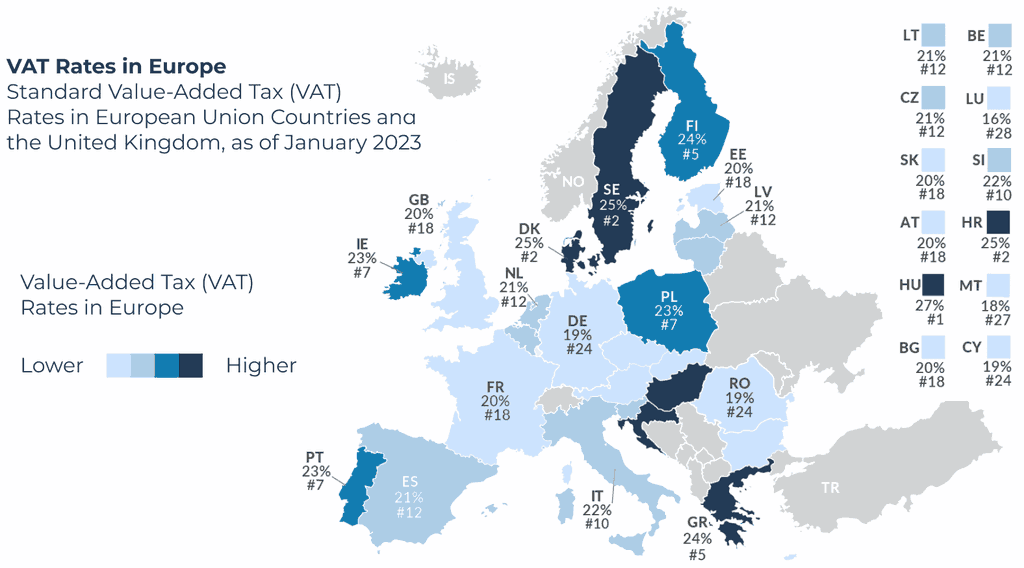

- Value Added Tax (VAT) – 18%, levied only on deliveries within Georgia

- Tax on property (Corporate Property Tax) and land plots (Land Property Tax), if owned by a business – up to 1%

- Excise Tax – depends on the type of goods imported into Georgia, applies to only a small number of companies

- Import Tax – 0% or 5/12%.

How to reduce the tax burden

The easiest way is to get special favorable tax status:

- Organizations that have been engaged in information technology for more than two years (in Georgia or abroad, though in the second case, the controlling interest must be owned by the foreign partner) can be recognized as an international IT company, automatically reducing VAT to 0% and corporate and income tax to 5% with no need to withhold anything when distributing profits

- Any IT business can become a member of the virtual zone, exempt from VAT and corporate tax – for more detail on how to become a participant in such a zone, check this out

Registration in a free industrial zone (Tbilisi, Kutaisi, Poti) exempts you from five of the six taxes listed above (including excise and import tax) but not income tax (PIT), which remains at 20%

To learn more about special tax regimes, sign up for a totally free 30-minute consultation with a PB Services specialist. We can help you find the tax regime best suited to your business, help you open a company, and take you through all the legal procedures.

When to pay corporate tax and to whom

On January 1, 2017, Georgia switched to the so-called “Estonian Model” of taxation, whereby a company’s profits are not subject to corporate income tax (CIT) as long as the profits are not distributed. If an organization reinvests all the money earned back into the business, it is exempt – a measure encouraging company expansion.

Corporate tax is 5/15%:

- When dividends are paid to shareholders (total amount of distributed profit for the taxable base)

- When expenses are not related to economic activity, for example, not documented, related to the purchase of shares/loans for a non-resident company (i.e. withdrawn abroad), and so on, reducing the risk of hidden profit distribution for tax avoidance while allowing the transfer of assets between subsidiaries without incurring tax

- When hospitality expenses (for business meetings and negotiations) exceed the limit – the limit according to Article 98⁴ of the Tax Code is 1% of the profit of the company in the previous year (or 1% of the expenses incurred, if they exceed the income)

Important: the “Estonian Model” does not apply to banks, microfinance organizations, pension funds, and gambling operators (insurance companies will join in 2024). As of 2023, these companies are subject to corporate tax according to international standards and pay 20% on any profit (difference between income and expenses) with a dividend tax of 0%.

And just a reminder: members of free and virtual zones are exempt from CIT when exporting their services and goods abroad. International IT companies pay 5%.

Dividend tax on profit distribution

As we wrote above, a company is obliged to withhold corporate and dividend tax (as income tax of shareholders) at the rate of 5% when paying dividends from both residents and non-residents (though the latter can apply international double taxation treaties signed with 58 countries).

There is a caveat: this falls under the definition of return of capital and is not taxable if the company pays dividends out of the original investment rather than from profits.

International IT companies and participants in free industrial zones do not withhold tax on dividends at all – tax is 0% in all scenarios.

Income tax on employee salaries

Everyone – regardless of residency – pays tax on income received from a source in Georgia (in our case – from a Georgian company). It is often the customer/employer who becomes the tax agent, but:

- a resident employed officially under an employment contract is taxed at the rate of 20%, and the company must withhold 2% of the salary and add 2% as a pension contribution (another 2% will be assessed by the State)

- a non-resident employed under the LC is also taxed at the rate of 20%, though without the pension contributions

- a resident on a contracting agreement is taxed at 20%

- a non-resident contractor is subject to “withholding tax” instead of income tax, at 10%, though it can be reduced to 0% if there is a double taxation agreement between Georgia and the employee’s country of residence

- an individual entrepreneur or a legal entity acting as a contractor declares their income themselves

Organizations with international IT company status pay income tax at the rate of 5%.

Although a living wage has not been officially defined in Georgia, the Georgia Fair Labor Platform places it at GEL 1,858/month. To provide this amount, the actual salary must be about GEL 2,370 before the deduction of 20% and pension contributions.

Value added tax

Companies are obliged to register as a VAT payer when their turnover from operations within Georgia exceeds GEL 100,000 over a 12-month period. That is, if an organization has earned for instance, GEL 500,000 abroad but only GEL 25,000 (so less than 100,000 GEL) in Georgia, they don’t need to register as a VAT payer, though they can do so voluntarily – sometimes it is economically justified (more details below).

VAT is imposed on most goods and services sold or rendered in Georgia (except for financial, medical, and educational, and oil and gas activities). The rate is 18% in all cases.

As is common practice worldwide, regular VAT is formed of two taxes: outgoing (when you buy goods from a supplier) and incoming (a company charge to itself when selling goods). The difference between the two is the actual VAT expense.

If a Georgian company is registered as a Virtual Zone company or a member of a free/virtual zone, VAT is 0%.

VAT for foreign IT companies

As of October 1, 2021, digital services from foreign companies that do not have a representative office in Georgia are also subject to VAT when these services are rendered in Georgia. The latter is considered to be true if:

- The account into which the payment for the service is received is in a Georgian bank

- The service recipient or the network address of their device (IP) is located in Georgia

- A Georgian phone number is involved in the payment process

The Ministry of Finance has a separate website for foreign companies with guidance on declaring and paying VAT.

What is reverse VAT?

If an organization works with foreign contractors (which are almost uncontrollable for tax regulators), it has an obligation to declare reverse VAT (also called refundable VAT) of 18%. At the same time, Article 176 of the Tax Code of Georgia explicitly states that if a company is registered as a value added tax payer, it can offset reverse VAT immediately at the moment it is reflected in the declaration, i.e. it is not actually required to pay it.

How to work properly with contractors

In our experience, Georgian companies tend to ignore the tax from ordering goods or services abroad, though it could be optimized to avoid two taxes at once:

- First, reverse VAT, by registering as a VAT payer immediately, regardless of company turnover – not doing this will incur a rate of 18% every time you import services.

- Second, income tax – 10% when working with foreign contractors (individuals and legal entities) that can be reduced to 0% if you can confirm the tax residency of your contractor with the relevant certificate and a double taxation agreement has been signed in that country

For example, a Georgian company rents a server from a contractor from Germany for EUR 3,000/month and must pay income tax of about GEL 890 per month (at the exchange rate of the National Bank on the date of payment) by default. But Georgia has signed a DTA with Germany, meaning if you get a certificate from the counterparty to confirm that it already pays taxes in its country, money can be saved…

Property tax

This tax is payable annually if the company had so-called “fixed assets” on its balance sheet in the reporting year. These include real estate (including investment property), as well as vehicles, equipment, inventory, computer equipment and so on (assets acquired in leasing are also counted). The tax rate for companies is 1% of the value of the property.

By default, the value of property is determined from its balance sheet in the accounting statements (as the sum of the value at the beginning and end of the year divided by two, with possible depreciation at the end of the year). In some cases, the company may use market valuations if the difference between the amounts exceeds 10%.

In addition, a separate land tax is levied if a company owns land. The rate depends on the size of the plot and the region (check out the exact figures here when filing the relevant declaration or using the online calculator).

International IT companies do not pay property tax on assets if they are used for business activities, and participants in free industrial zones are exempt from tax on assets that are located within the PPE.

Excise and import tax

- There is excise tax on imports (but not exports) of alcoholic beverages, tobacco products, liquefied natural gas, crude oil products, and automobiles. The rate varies from GEL 0.6 to 800 per unit of goods. Details can be found in Articles 182 et seq. of the Tax Code of Georgia.

- Import tax (aka customs duty) is levied on goods when they cross the border. The full list of goods is in Article 197 of the Tax Code. In particular, the tax rate is 12% when importing many food products, construction materials, jewelry. The rate of 5% applies to cheese and cottage cheese, a number of cosmetics, and clothing. There is a different formula for cars (in addition to excise duty): GEL 0.05 for each cm³ of engine volume plus 5% of this amount for each year of operation. Goods imported for humanitarian aid or financed by grants are exempt from tax.

Making a tax declaration

Taxes in Georgia are paid online on the website of the Revenue Service – you get access the moment you register a company, and a Georgian phone number is enough to enter your personal account. The website interface is in Georgian and English. You can check it out without registering, through test access (click on the Login button and select “სატესტო1” in the drop-down list under the login/password field).

Most of the taxes listed in the article – income tax, corporate tax, regular and reverse VAT, dividend tax and excise tax – are declared and paid monthly – by the 15th of the month following the reporting month (if there is a taxable base).

Import tax is paid at the same time as customs clearance.

Property and land tax must be declared and paid annually – by April 1 of the year following the reporting year. If a company had real estate or transport on its balance sheet in 2024 (for any number of months), the tax must be declared and paid by November 1, 2025.

There are some finer points that have not made it into this article, and at the end of the day – your tax obligations depend on your company activities. To make your reporting crystal clear, you can outsource your accounting. PB Services can help you get any business documents in order and organize the work of your HR-department.