All companies and individual entrepreneurs registered in Georgia are required to report their activities to the state. The legal framework for the reports can be found in the Tax Code, the Law on Entrepreneurs, the Law on Accounting, Reporting, and Audit, and regularly updated (annual) regulatory instructions, among other acts, and is understandably complicated.

The documents are generally close to EU directives, and International Financial Reporting Standards (IFRS) are used for accounting. The Ministry of Finance of Georgia’s Service for Accounting, Reporting and Auditing Supervision (SARAS) publishes standards with all the updates on its website every year.

Essential business documents

The list of documents a business might encounter when interacting with the state is considerable and bound to include:

- Monthly tax returns: VAT, income tax (based on payroll), corporate income tax, dividend tax and excise tax — filed by the 15th of the month following the reporting month. We provide a breakdown of taxes for businesses in this article.

- Annual tax returns: for property and land tax, for example, the business must report by April 1 of the year following the reporting year.

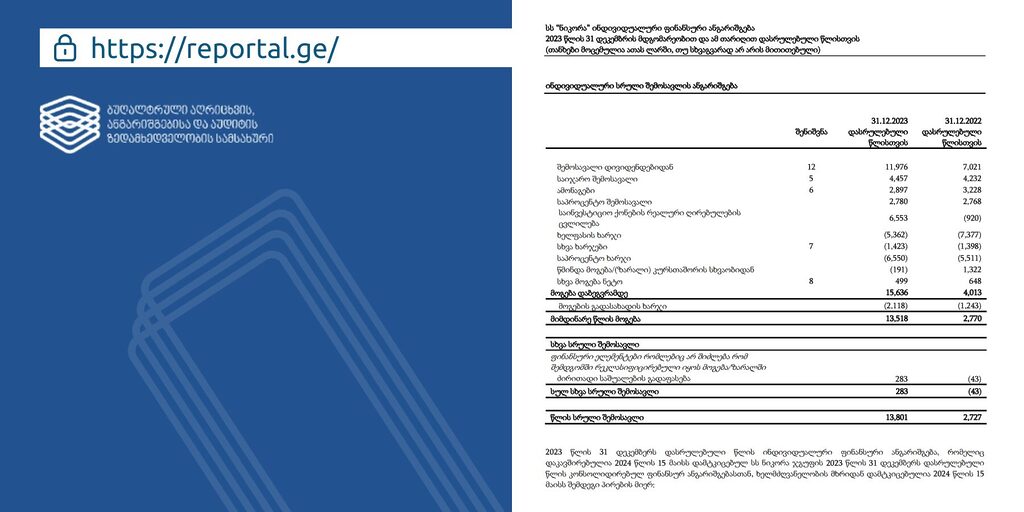

- Annual financial reports include forms on profit and loss, balance sheet, results of economic activity, development plans, securities transactions, and risks. We explain the content of such reports here. Must be filed by October 1 of the year following the reporting year.

- Annual management (non-financial) reports on corporate governance, environmental protection, social and other issues must also be submitted by October 1.

- Various other legal documents include articles of incorporation, internal regulations, minutes of shareholder meetings, contracts with contractors, and licenses and primary accounting documents such as invoices and payment orders

Again, the possibilities are near endless and depend on the type of business and area of activity. For example, sole proprietors with micro-business status (entrepreneurs with annual turnover of up to GEL 30,000) have to submit only a single simplified annual income tax declaration. But first and second category Georgian companies (with assets from GEL 10 million and GEL 20 million and more than 50 employees) are also required to undergo an independent audit of financial indicators.

All of this is the responsibility of the accounting department (and company management).

I filed a report late — what now?

The short answer: penalties. 10% of the amount payable for submitting your tax declaration late, for one. Underreporting tax can incur a fine of up to 50% of the amount, and if it is understated by more than GEL 100,000 — criminal liability.

Failure to submit accounting documents, financial or management reports, or an audit report may result in a fine ranging from GEL 500 (for category four companies) to GEL 10,000 (for category one). The company will also receive a written warning, and if the problem isn’t handled, the fine can double.

Ignoring a request for additional information from tax authorities is punishable by fines of GEL 10,000 and 20,000 (for first and second offenses).

And the list goes on and almost certainly warrants employing someone specifically to deal with the documents and reports (micro-enterprises excepted). If you own a business in Georgia, you really ought to hire an accountant (someonewho knows the language — everything’s in Georgian) or outsource the accounting.

Why you should consider outsourcing your bookkeeping

PB Services provides all the accounting services a business in Georgia could need, and our clients hail from the USA to China and everywhere in between. We are well-equipped to deal with Georgian and international legislation and well-versed in the norms of individual countries — a big plus if you need to go past simply satisfying the requirements of the law and optimize your tax burden.

Advantages of outsourcing bookkeeping include:

- It is usually cheaper than employing staff full time. Full-time salaries include taxes and vacations. An agency can fulfill a specific service and be done with it.

- The expertise of an entire team. You get a whole department of experienced accountants responsible for their own specializations.

- Well-established processes and guaranteed results. To find an in-house expert with an understanding of Georgia, you’ll need a basic understanding of local laws yourself, especially difficult if you’re just starting to work in Georgia. PB Services’ professional accountants and internal control systems already have the expertise and eliminate any possible errors.

- Experience dealing with regulatory authorities. We’ve already helped more than 300 companies file reports and developed contacts with the tax authorities in the process. We know where to turn to solve your problems

- Quick response to legislative changes. The legal framework can change over time, and when it does, we are among the first to know. This happens more often than you might expect: for example, by January 2024, all companies in Georgia founded before 2022 had to update their charter.

Schedule a free consultation with PB Services for accounting or any other legal issues — we’ll assess your situation and tell you how we can help.

Accounting services we provide

- Regular analysis of your business for tax liabilities.

- Processing and entering primary documents into the electronic database.

- Preparation of financial and management reports in accordance with IFRS standards.

- Preparation and filing of all types of tax returns.

- Ensuring your taxes are paid within the statutory deadlines.

- One-off and ongoing tax and financial advice. We can help you assess the potential burden on your business before you make any strategic decisions (read: mistakes).

- Communicating with tax and customs authorities (and banks) in case of questions or audits.

Learn more here about all of PB’s Services

Businesses that should be particularly vigilant

As we’ve already said, everyone has to pay the piper, whether individual entrepreneur or multinational conglomerate. Not everyone, however, grasps the scope of the reporting involved.

Here are some examples to look out for.

IE with small business status

For individuals making less than GEL 500,000 per annum the accounting isn’t very complicated, and in theory you could do it yourself, but:

- Don’t miss any filing deadlines if you don’t want to pay penalties.

- Make sure you read any messages you get in your personal account from the tax office and answer right away — the regulator may, for example, unexpectedly request additional documentation.

Keep track of changes to legislation. Aye, there’s the rub. The tax office publishes regulatory updates in Georgian. Did you know, for example, that on January 1, 2025, the form of the monthly tax return and the procedure for filling it out changed for IEs with small business status? How income is received now requires a second look.

We provide individual entrepreneurs with monthly support and one-off consultations during which we can show you how to fill out your tax return and provide you with a detailed video you can come back to at any time. Just drop us a line!

Cryptocurrency companies with VASP status

In Georgia, it is technically possible to engage in cryptocurrency exchange and other blockchain activities with Virtual Asset Service Provider status from the National Bank, but there’s more to it than a simple license.

Like compliance obligations. You need to collect information about customers and the origin of funds (KYC) and submit it to the regulators on time, a task that falls squarely on the shoulders of your accounting department. Then a company (with or without VASP status) that earns profits from cryptocurrency trading may be required to pay corporate tax of 15% and dividend tax of 5%. And there are other aspects of dealing with digital assets that require a high level of accounting expertise.

Participants in free industrial zones (FIZ)

A company registered in one Georgia’s four free industrial zones (Tbilisi, Poti, Kutaisi, or Hualing) is exempt from all existing taxes except the income tax on employee salaries (20%).

But this does not mean that a business is exempt from reporting. FIZ participants must still declare receipts, file annual financial and management reports, and retain primary documentation. Take, for example, this subtle point related to the sale and purchase of goods: there is no import and export tax if the counterparty is located abroad. If the counterparty is in Georgia it’s 4%. So you see, this alone has the potential to earn your accounting team overtime.

International IT company status

This preferential status reduces VAT and dividend tax to zero and corporate and income taxes to 5%. But a lower tax rate doesn’t mean no accounting.

- First, international IT companies often operate as branches or subsidiaries of foreign legal entities, so they must take into account the uniform policies of the parent, and in some cases provide additional information to investors.

- Second, a general orientation toward foreign markets means the document flow must consider different jurisdictions.

- Third, honest currency accounting is extremely important — the law requires all funds to be reported in Georgian lari.

PB Services works with all types, including LLCs and JSCs, and lines of business, from IT and cryptocurrency to manufacturing. Let us take care of your accounting needs. If you still have questions, make an appointment for a free consultation or leave a request in the form below and we’ll get back to you.