The beginning of Donald Trump’s second term as president looks a lot like shock treatment aimed at reorganizing the world’s supply chains. As stock markets writhe in pain and the oil market does its best impression of St. Vitus’ Dance, the world’s largest economies, China and the United States, lock horns.

At the time of writing, prohibitive reciprocal duties between China and the US in 2025 include 145% on goods imported into the US from China and 125% on exports from the US to China, changing by the day, with the White House bandying about the number 245%, and a response in kind expected from Beijing.

Alternatives for Chinese businesses

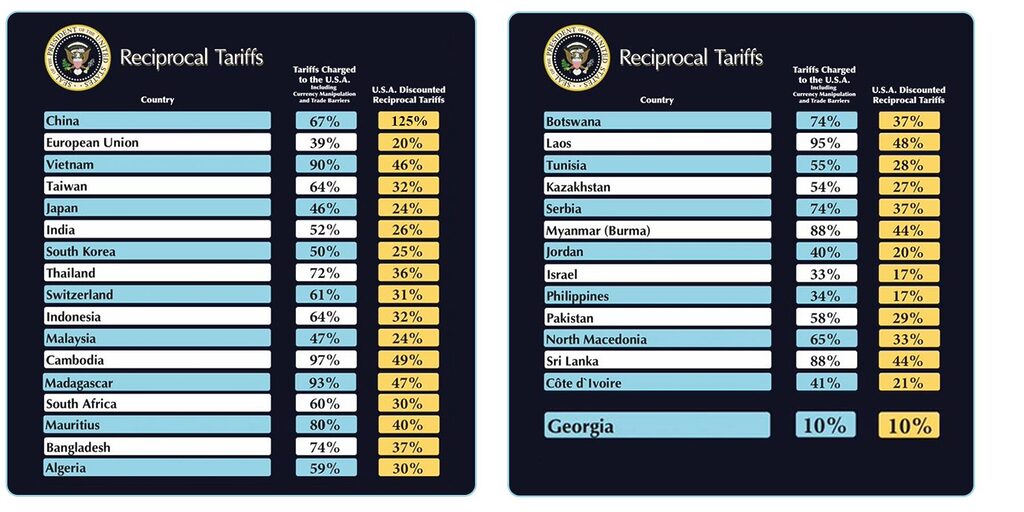

The long arm of Donald Trump is reaching beyond just China, as the US announces import duties for virtually the entire world, 211 states in all, making it increasingly difficult to find a safe harbor for production. For example:

- Businesses from China have been moving to Vietnam in recent years for re-export to the US, but a tariff of 46% there…

- Cambodia, Thailand, and other states where Chinese companies have managed to localize production have also been hit with tariffs of 30 to 50%

- And even the EU and the USA’s closest neighbors are not immune: 40% for the EU, 25% for Canada and Mexico, where high taxes and red tape are already problems

The 90-day postponement (not extended to China) is set to end in early July, making it high time to start looking for alternatives to move production and diversify risks.

Chinese companies won’t find a better choice than Georgia, one country Trump has chosen to impose the lowest possible tariff on, only 10% on imports, because of the positive trade balance (USD 1.7 billion of goods imported into Georgia and USD 165 million exported in 2024) that exists between the two countries. And it’s not the only reason to move production to the heart of the Caucasus Mountains.

A strategic location at a strategic crossroads

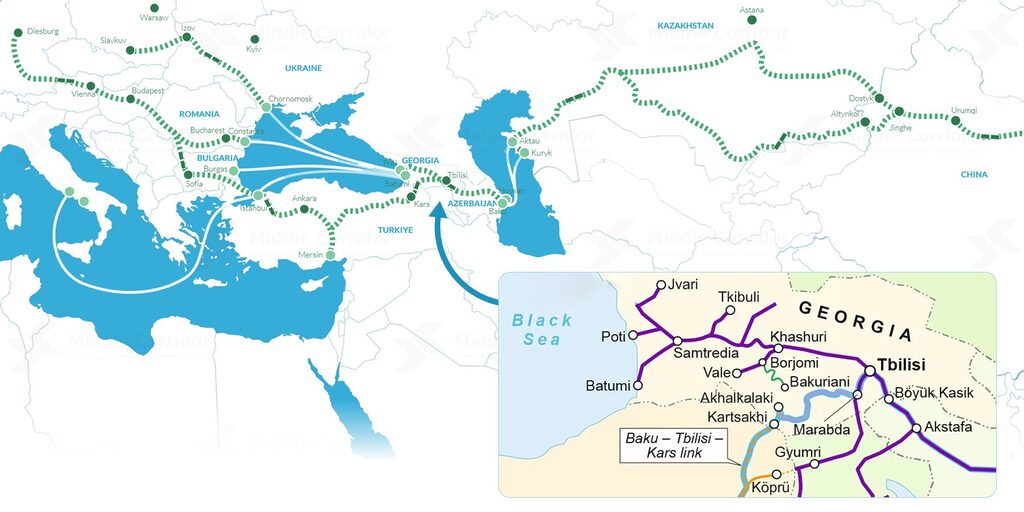

Caravans traveling the Silk Road have passed through Georgia, located as it is at the crossroads of Europe and Asia, since ancient times, with China breathing in new life as part of its ambitious Belt and Road, or 一带一路.

It could be argued that Georgia is the most important point on this route, at the tip of the Trans-Caspian International Transport Route (TITR), or Middle Corridor, connecting China to Europe via Kazakhstan, the Caspian Sea, Azerbaijan, and Georgia. Goods then enter Turkey overland or the EU via the Black Sea.

Shipments along the TITR are growing at a record pace. According to Georgian Ministry of Economy estimates, container traffic between China and Georgia grew by 1,500% in 2024 to 12,687 TEU (20-foot containers). 4.5 million tons of goods passed through the Middle Corridor last year, and with the way railroads and ports are modernizing capacity is projected to grow to 17 million tons in the next few years.

TITR is distinguished by speed. It takes just 10-15 days for goods to get from China to the EU (it takes at least twice as long through the Suez Canal). Imagine how moving production to Georgia would cut your delivery times…

Georgia’s favorable terms for trade with other countries

Georgia has signed Free Trade Agreements with key partners in the EU (DCFTA), EFTA members (Switzerland, Norway, Iceland, Liechtenstein), members of the former CIS (Kazakhstan, Ukraine, Armenia, and Azerbaijan), as well as Turkey, the UAE, China, and Hong Kong. And there are possible agreements on the horizon with South Korea, India, and Israel.

In most cases, this means full liberalization of trade between the countries participating in the agreement, i.e., no tariffs. In some cases, restrictions apply to a small category of goods, about 5% of the total turnover between the countries (for example, the EU imposes duties on garlic).

Georgia’s own trade policy is also one of the most liberal in the world. 90% of goods are not subject to import tax (even in the absence of a free trade agreement), with 5 to 12% applying to the small remainder. In any case, there is no export or re-export tax regardless of the product category.

A complete list of goods with import tax can be found in Article 197 of the Tax Code of Georgia. To find out how Georgia might be suited to your particular business, contact PB Services for a free consultation.

Low taxes for foreign business

Georgian preferential tax regimes include options for individual entrepreneurs, with small businesses paying tax at 1% of turnover, and virtual zone or International Organization status for companies, primarily for software startups.

For Chinese companies that plan to move production to Georgia, free industrial zone (FIZ) participant status could well be the most beneficial as it brings the maximum tax reduction:

- VAT is 0% (for others it’s 18%, including when importing to Georgia)

- Corporate income tax and dividend tax is 0%

- Tax on the import of goods and services from abroad (outside Georgia) is 0% even without free trade agreements

- Property tax in the free industrial zone is 0%

- Income tax, calculated for employee salaries, is 20% for all companies

As of today, there are four FIZs in Georgia: in the capital Tbilisi, in the port city of Poti, and in the third largest city of Kutaisi, and one of the zones in Kutaisi was founded by the Chinese company Hualing back in 2012. Read more about FIZs here.

Hualing is a great example of Chinese business success in Georgia, and it’s not the only one. There are also China Railway, China Communications Construction Company Limited, Sinohydro Corporation LTD, Guizhou Highway Engineering Group, CEFC China Energy Co, Nuctech Company Limited, and more. China and Georgia signed a strategic partnership agreement in 2023, after which the number of Chinese companies registering here increased by 96.6%. Some 300 businesses from China were launched here in 2024 alone, and the numbers will only increase.

An attractive labor market

According to the National Statistics Service, the population of Georgia in 2024 was 3.7 million people, 1.65 million considered able-bodied and 234,000 looking for a job, i.e., with an unemployment rate of 14.2%, meaning it’s not hard to find personnel.

And they tend to be pretty qualified: 39.6% have a higher degree, 16.9% vocational.

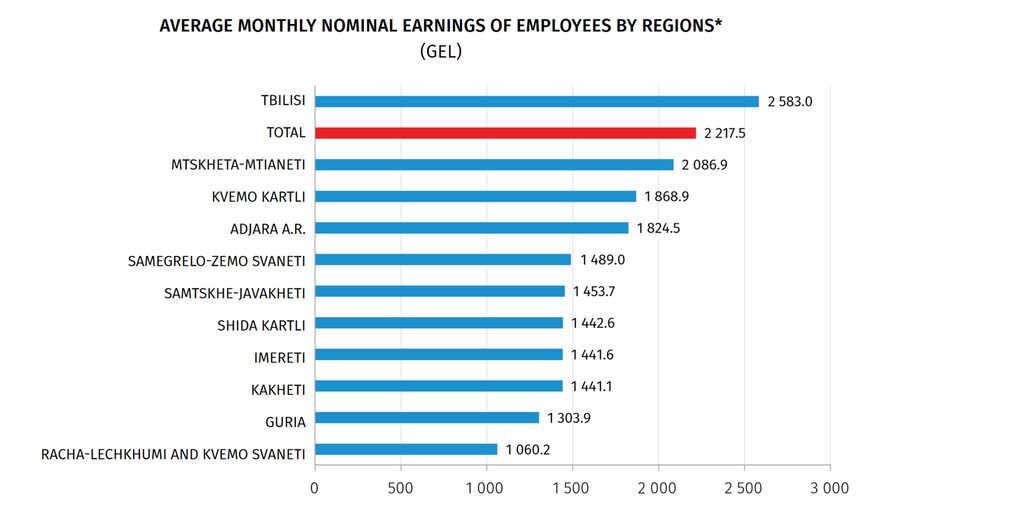

Salaries in Georgia are employer friendly. As of the end of 2024, the average salary had risen to GEL 2,217 (USD 809) per month: GEL 2,583 (USD 943) in the Capital and just GEL 1,824 GEL (USD 666) in Batumi and GEL 1,442 (USD 526) in Kutaisi, pay varying by USD 0.5 to USD 2 per hour depending on the city and much lower than the average salary in China.

There are no hidden taxes for employers in Georgia. Apart from the above-mentioned personal income tax of 20%, companies pay only 2% to the pension fund for local employees. No such contributions are required for non-resident employees.

Other benefits of Georgia

- A stable, growing economy: The International Monetary Fund predicts annual growth of 5% until the end of the decade, keeping pace with China in terms of growth

- Developed infrastructure: The country has three international airports (in Tbilisi, Batumi, and Kutaisi), several ports, and a developed network of roads and railroads, some built by Chinese companies…

- Optimal climate: Warm summers and mild winters. In contrast to Asia and the Americas, Georgia is unscathed by natural disasters, sparing businesses the additional costs

- The low cost of living: about USD 1,000 per person in the capital, according to travel portals. We wrote about the cost of food, gasoline, and housing here

- Visa-free entry for citizens of almost 100 countries: Show you passport at the border and stay in the country for up to a year

- Legislatively guaranteed openness to international business: Meaning no bureaucracy and the possibility to open a company in next to no time

- Developed banking and openness to cryptocurrencies: All major banks work with non-residents, accounts can be opened remotely, there are many crypto exchanges in Georgia, and businesses can use digital payments as part of their economic activities

- Hospitality to foreigners: In addition to traditional hospitality, Georgia’s economy has long depended on tourism, and as an additional plus for entrepreneurs, many people in the country speak fluent English

***

The World Trade Organization has warned that Trump’s new tariffs could slow global GDP growth to 1.1%, a total loss of more than USD 1 trillion. That said, no forecaster can yet say how quickly the world will adapt to the new supply chains.

Let us help you take the first step to adaptation. A new company in Georgia is a good way to legally reduce prohibitive tariffs, send goods to the US, or, conversely, export at favorable rates. To learn more, contact us through the form and schedule a free consultation.