How does Tax Residency in Georgia work?

Georgia has attractive tax rates for foreigners and also, a territorial tax system, where the government does not tax you in your foreign sourced income.

Georgia has two kind of residency: Legal and Tax residency. In order to receive above-mentioned benefits, you must be a Georgian tax resident. You can be a legal resident without being a tax resident or the other way round, or both simultaneously.

As a tax resident of Georgia, you pay tax in that country. In addition, Georgia has around 58 Double Taxation Avoidance Treaty. That gives Georgian tax residents potential benefits for their incomes received from countries, which are member of this treaty.

For example, if you have tax residency in Georgia and receive income from any member country of Double Taxation Avoidance Treaty, the local tax authorities will not tax you abroad on your rental income, dividends, capital gains, or any business that you possess abroad.

highlights

Criteria to obtain tax residency in Georgia

Spend at least 183 days in Georgia

You must spend 183 total days physically present in Georgia in any 12 month period. After that you are automatically a tax resident of Georgia for the whole year.

It does not need any application process or visit in any governmental institutions, it happens automatically. This rule applies to any person within the borders of Georgia.

OR

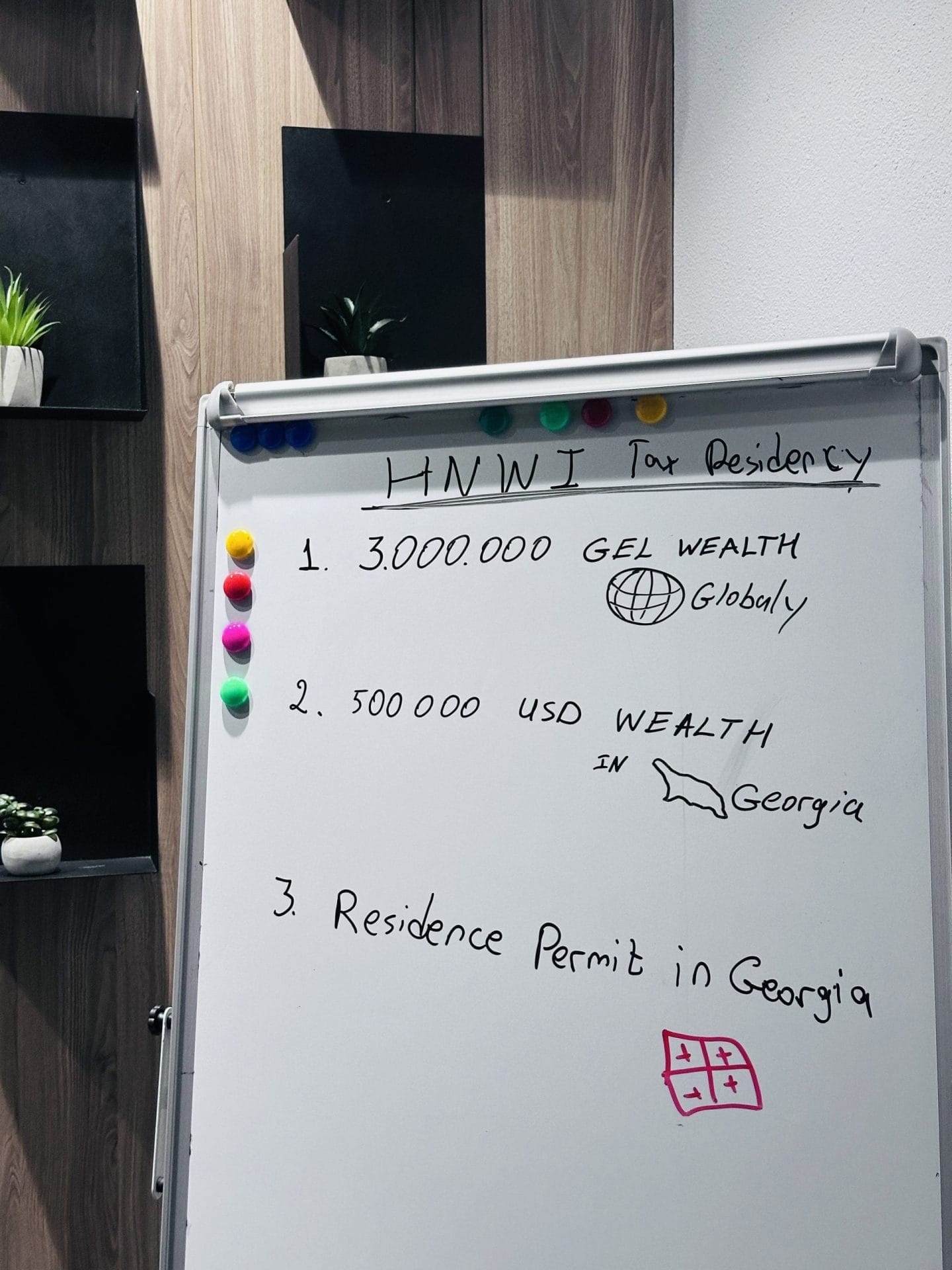

Be a High Net Worth individual

If you do not want to spend 183 days in Georgia, there is another way to obtain tax residency through the High Net Worth Individual (HNWI) program. To qualify for Georgian tax residency under the HNWI program, you need to meet three criteria:

- Total Wealth:

- Possess a total wealth of at least GEL 3,000,000 (approximately 1.15 million USD) anywhere in the world. This can include cash, real estate, stocks, bonds, cryptocurrency, or other assets. Alternatively, you can qualify by having an annual income of more than GEL 200,000 (approximately 75,000 USD) for each of the last three consecutive years.

- Assets in Georgia:

- Own assets in Georgia worth at least 500,000 USD. This can simply be cash in a Georgian bank account.

- Connection with Georgia:

- Have a Georgian residence permit or demonstrate an income of at least GEL 25,000 (approximately 7,500 USD) from Georgian business activities in the previous year.

Benefits

Benefits of Georgian Residency

Exemption for foreign sourced incomes

Please note, the tax code of Georgia defines which income is foreign sourced and hence tax free. Not all the income that is generated outside of the territory of Georgia is foreign sourced.

Double taxation avoidance treaty

Avoidance of a CRS reporting

Or will be shared only with Georgia, in case you have a bank account in some other country. Remember, Georgia does not tax foreign source income.

Low Tax Rates

Even if you have a local source income it can be taxed with 1% in case you register as an IE. Or if without any exemption, tax will neve exceed flat 20%.

Easy access to Georgian bank system

Becoming Georgian tax resident solves the problem. Once you are a tax resident in Georgia, banks treat you as a local, avoiding heavy compliance and procedures.

Get in touch

Step by step

Georgian tax residency as High Net Worth individual

Getting legal residency in Georgia

If you can not declare above mentioned income from Georgian source, than you must apply personally for legal residency in Public Service Hall in Tbilisi.

Obtaining tax residency certificate

Keeping residency status

Support

Here’s how we help you

Consultation before you start application

It might be a good idea to get a local company or sole entrepreneur status (almost tax free)

Assistance in collecting documents

Personal assistance during application process

Monitoring and renewing your residency status

If you don’t wish to manage all the paperwork process every month, we can take care of your monthly obligations.

Managing your tax liabilities

If you don’t wish to manage all the paperwork process every month, we can take care of your monthly obligations.