A strong tourism sector has resulted in strong demand for residential real estate, oftentimes to the neglect of commercial properties. Multi-year contracts concluded for office space, warehouses, stores, and restaurants, however, can mean a more stable income for a similar investment per square meter and pay off faster, with rent for commercial space two to three times higher than for apartments.

Market potential: The numbers say it all

Statista predicts that record GDP growth, 25% of which is in trade and manufacturing – big users of commercial buildings, will drive Georgia’s commercial real estate market to USD 34 billion in 2025 and USD 42.6 billion by the end of the decade.

Georgia’s economy grew by an average of 10% annually between 2021 and 2024, with the first quarter of 2025 maintaining a similar pace at 9.3%. Even the 5-6% of conservative Asian Development Bank and European Commission forecasts would be twice the global average (and six times that of the European Union).

Besides the general state of the economy, the commercial real estate market is also influenced by:

- The tourism sector (more people crossing the border means more people in stores and restaurants). According to Galt & Taggart, 5.1 million tourists visited Georgia (+8.5% YoY) in 2024, worth USD 4.4 billion (+7.3% YoY) in revenue. And the government expects that to grow to 11 million people, for revenue of USD 6.5 billion, in the next four years.

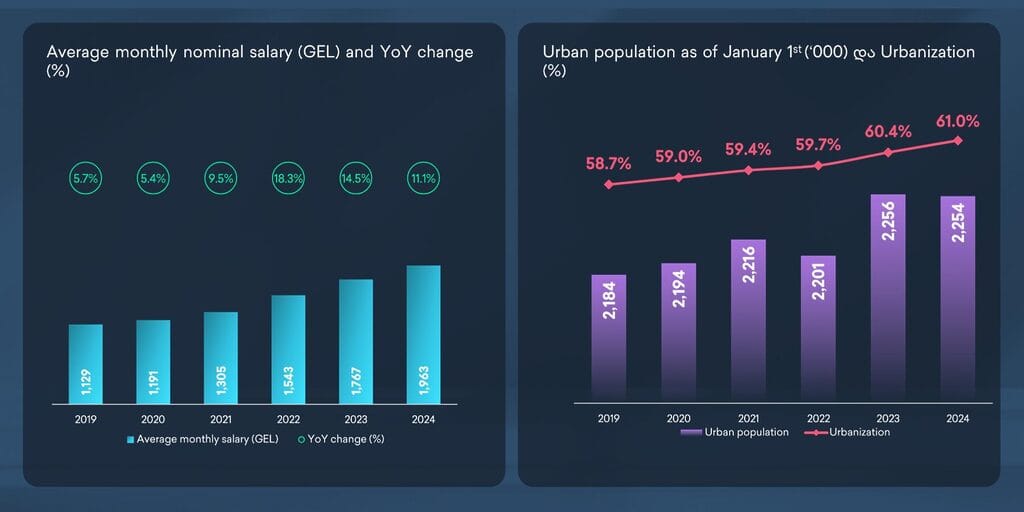

- Consumer activity (more spending equals higher demand for commercial space). Ten years ago Georgians spent GEL 1 billion every month (inflation, by the way, averaged 4.82% annually then, and has since fallen to 3.4%). They now spend twice that much, and there are no signs of spending slowing down. On the contrary, according to actual transactions at TBC bank, spending has increased by 10-15% every month since the beginning of 2025.

- Urbanization (the more people in the city, the higher the demand for well-organized shopping spaces). 61.5% of Georgia’s population is now concentrated in urban centers, still 15% behind the EU, with great potential for growth.

Profiting off commercial real estate

Annual income from commercial real estate is estimated at between 7% (for restaurants) and 12% (for retail) in larger cities like Tbilisi and Batumi. Of course, the exact figures depend on location (neighborhood, infrastructure, proximity to residential complexes), class, and many other factors.

For example, according to TBC Capital’s industry report for 2024 you can find Class C office space for purchase in Tbilisi from USD 1,000/square meter with an average rental price of USD 13/square meter, while Class A office space going for USD 3,000/square meter can rent for USD 28/square meter.

Investment opportunities abound. In addition to offices, there is high demand for store premises on the first floors of new buildings and in large shopping centers. The FMCG sector is one of the fastest growing in Georgia, with companies increasing their revenue by 16-20% annually and actively expanding.

And then there are dry and cold storage warehouses, where demand can be especially high due to the fact that Georgia is a key hub on the New Silk Road connecting China with Europe.

Commercial real estate also includes hotels and medical centers, but each sector requires in-depth research. To get help refining your search, book a free consultation with PB Services.

Guaranteed passive income in warehouses and offices

- If you invest USD 100,000 or more in commercial or residential real estate, your spouse and minor children can also get a one-year residence permit.

- If you invest at least USD 300,000 in real estate (or the Georgian economy), you can count on a five-year investment residence permit, which also extends to family members and after five years can become permanent.

- If you invest at least USD 500,000 in real estate (or less together with a deposit in a bank account), you can join the program for High Net Worth Individuals that gives you tax residency without having to live in Georgia for the usual 183 days a year.

The finer points of taxing commercial real estate

- There is no tax on the purchase of real estate in Georgia.

- Rental income tax is a basic 20% of the difference between rent and real estate expenses (repairs, maintenance, etc).

- Annual real estate ownership tax (a.k.a. property tax) depends on the total income of the investor. But even with a maximum annual income of GEL 100,000 (about USD 36,500) the rate will not exceed 1%. For smaller incomes it is up to 0.8%.

- Income tax on the sale of real estate is not charged if you’ve owned it for at least two years (if less, the rate will be 20%).

Important: If you make GEL 100,000 GEL by law you must register as a value added tax (VAT) payer, obliging you to pay 18% of the rent and/or the amount of the sale in case of withdrawal from the investment.

This part can be improved upon, however, by registering as an individual entrepreneur and qualified VAT payer in advance, to receive an 18% deduction when making your purchase and charging the tenant the same 18% VAT every month if they are a qualified VAT payer (and don’t worry, you’re not just passing the buck: They can also apply for a VAT deduction in the same way).

How to buy commercial real estate in Georgia

The conditions do not differ from the purchase of residential real estate: All you need is an identity document and a contract of sale (notarized, if you want, though strictly speaking it is not necessary). All the documents are submitted to the House of Justice and, after you’ve paid a small duty (USD 50-130), entered into the public register. With accelerated procedures, you can become the owner of the property on the same day you submit the application.

The transaction can also be done remotely by power of attorney, without visiting the country in person, and with the commercial real estate management process fully delegated to local agents. You will not need to meet the tenants, deal with contracts, or manage the tax: Just earn your passive income and watch the value of your asset grow. Depending on the city and neighborhood, commercial real estate can appreciate by 20-50% per year!

To learn more about the best investment opportunities in Georgia for foreigners, use the form below to get in touch with the specialists at PB Services. We will help you find the best strategy for your needs, budget, and risk tolerance.