Why Georgia is attracting foreigners right now

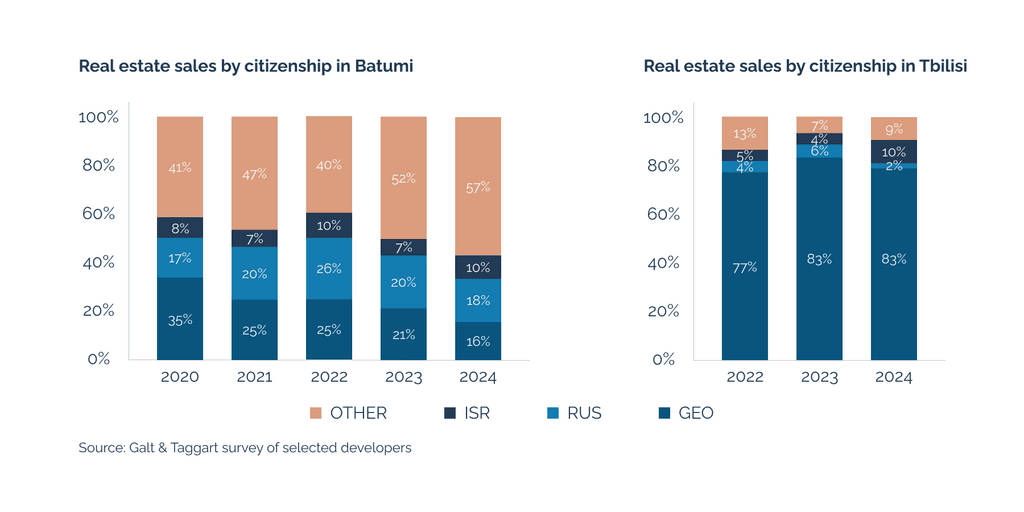

According to Galt & Taggart, in 2024 foreigners accounted for 21% of all residential real estate purchases in Tbilisi, the capital of Georgia, and 84% in Batumi, the second largest city. And the reason is simple: in the last two years the cost per square meter in new buildings has increased by 25% and 42%, respectively.

And there are other advantages. Non-residents can buy any type of residential property (just not on agricultural land), there is no tax on the purchase of real estate, and annual property tax does not exceed 1% of market value. Finally, a foreign national can obtain a residence permit by purchasing housing worth USD 100,000 or more and pay for the transaction with a mortgage from a local bank.

Applying for a mortgage

First, you’ll need to enter the country to take out a mortgage. Citizens of 90+ countries can visit Georgia without a visa and stay for up to a year. If you’re considering doing so, be prepared to spend at least a week. Few banks allow for an application to be submitted by a representative with power of attorney.

Second, you’ll want to choose the best bank for you.

Non-residents can obtain a mortgage from pretty much every big bank in the country. The most reliable are TBC, Bank of Georgia, and Liberty, and expats often look to Credo Bank and Basisbank. And for special clients, Bank of Georgia has a special unit called SOLO Bank.

Third, you’ll need to prove your financial stability, i.e., provide proof of income, which the bank will evaluate before deciding whether to shell out. The source of income can be either in Georgia or abroad (or in several countries at once). The main thing is that your earnings correspond to the minimum required for a particular bank. For example, Liberty requires GEL 500/month and Bank of Georgia GEL 400.

Other things to consider:

■ If your income falls short, some banks allow for a family member with sufficient income to be listed as a co-borrower

■ A residence permit is not a requirement but can increase the chances of approval. First, though, the bank will look at your financial stability and credit history

■ For some banks, the borrower’s age matters. For example, don’t bother applying at TBC if you’re aged between 20 and 65

Once the bank has learned all it needs to about you, it will dispatch an appraiser to inspect the apartment in question before finally determining the amount of the loan, the size of monthly payments, and the term.

Terms and interest rates at the big banks

Banks will often provide the loan in the currency in which you receive your income (provided it is the national currency where you receive the income). For example, if you work in the EU, you can get a mortgage in euros, or in dollars if your money is coming from the US. Otherwise, expect to get your loan in Georgian lari. The choice of currency can also be influenced by the size of the amount you plan to borrow. Bank of Georgia indicates on its website that loans equivalent to up to GEL 400,000 are issued only in the national currency of Georgia.

The interest rate for your mortgage will probably float, but the benchmark will differ. It is the TIBR 1M index from the National Bank of Georgia for GEL, SOFR for USD, and EVRIBOR for EUR. The rate is fixed for 5 years, after which it can be revised.

For example, TBC has the following rates for mortgages for the first quarter of 2025:

- ■ 10.7% per annum for GEL (including commissions and insurance of 11.5%)

- ■ 7.5% for USD (with all fees at 9.4%)

- ■ 6.4% for EUR (effective rate 8.2%).

The down payment for foreign nationals will be 30-40%.

If you can prove your income in Georgia for the last six months, some banks may consider reducing the down payment to 15% of the value of the apartment.

The mortgage term will depend on the bank (and currency). The term for mortgage repayment is longer for GEL than foreign currencies. Liberty Bank, for example, provides mortgages for up to 120 months in dollars and euros and up to 240 months in lari.

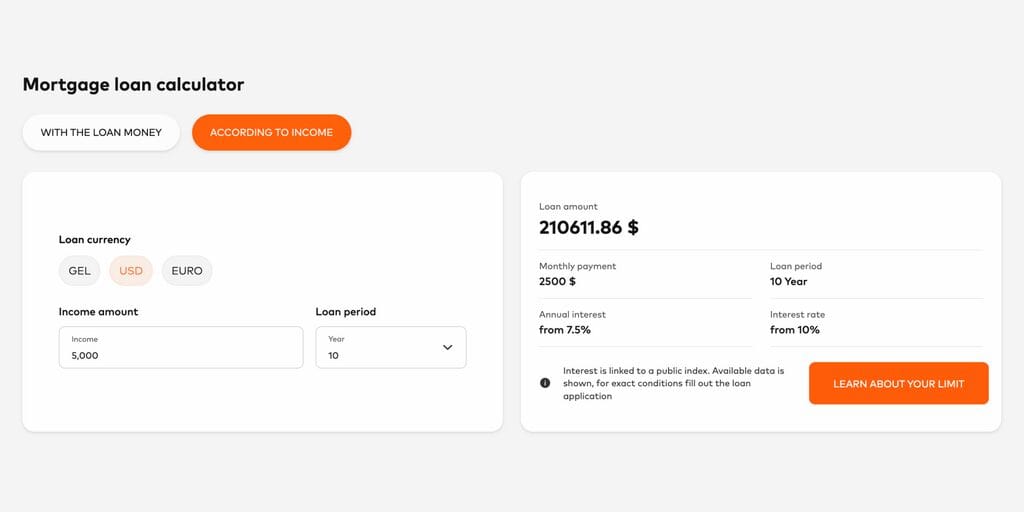

The maximum mortgage amount differs by bank. TBC specifies USD 500,000 (or the equivalent in GEL and EUR), while Basisbank offers mortgages up of to GEL 600,000 (or roughly USD 215,000). The actual limit, however, will depend on your monthly income. Bank of Georgia and TBC offer minimum loans of GEL 3,000.

The banks have loan calculators on their websites where you can enter the value of the apartment and the term you’d like so you can see what your approximate monthly payment would be by currency.

PB Services can help you choose the right bank and learn more about mortgage terms and paperwork. Sign up for a free 30-minute consultation to talk to an expert.

Documents required to apply for a mortgage

The usual suspects:

■ A completed application form

■ A passport

■ A residence permit (if you have one)

■ A document confirming your income

■ The bank reserves the right to request other documents, like an agreement on the purchase of an apartment or an employment contract, and sometimes you will need to fill in a questionnaire

If you already have an apartment picked out, you’ll want a copy of the sales and purchase agreement, which will indicate ownership and possible encumbrances (sometimes a mortgage is being paid on the apartment you want to buy).

Application processing time: from a few days to 2-3 weeks. During this period, the bank may request additional documentation or clarification.

Problems you may run into when applying for a mortgage

In spite of the relative simplicity of the procedure for obtaining a mortgage in Georgia, foreigners may run up against:

● A language barrier. Although many bank employees know English, the purchase and loan agreements and extracts from state registers will be in Georgian. So you’ll probably want to avail yourself of the services of a local professional

● Credit history and source of income. Financial stability plays a central role in loan approval. Look closely at the bank’s requirements and be ready to confirm solvency and provide supporting documents

● Fluctuations in the exchange rate and key rates. Expect the exchange rate and TIBR 1M, SOFR, or EVRIBOR benchmark to fluctuate and affect your monthly payments

● Other spending when taking out a mortgage. When opening a mortgage, don’t forget about other expenses: life insurance, bank fees, account opening operations, etc., reflected in the effective rate we have given above

● Additional conditions for non-residents. Before applying for a mortgage, find out if there are any restrictions for foreign borrowers that are not on the website. Go to the branch in person. Restrictions on the type of currency or the mortgage repayment period may apply.

Georgia is a beautiful country with a high standard of living and low taxes. The tourist sector is actively developing, offering property owners a potential alternative source of income. The purchase of real estate is simple and transparent, and the rights of owners are reliably protected by law.

Make your mortgage application even easier by contacting PB Services: we can tell you more about bank offers, help you open a bank account, and prepare all the necessary documents. Fill out the form below to find out more.