Georgia’s commercial and residential real estate market is projected to reach $185.7 billion by 2025, an increase of 100% over 2017. Thousands of purchase and sale transactions are made in the country every month, with non-residents accounting for a significant proportion of them. Only 78% of all residential real estate purchases in Tbilisi in the first 8 months of 2024 were made by Georgians, a number that dips to an astounding 20% in Batumi. And the explanation for the phenomenon is simple: it’s easy for foreigners to buy real estate in Georgia.

What you’ll need for the transaction

First of all, we would be remiss not to mention that any individual who has spent at least 183 days in the country in a 12-month period or who has been recognized as a High Net Worth Individual (assets of GEL 3,000,000 or annual income of GEL 200,000 for the last three years free you from the need to spend those six months in the country) is already considered a resident in Georgia. Non-residents are everyone else.

Fortunately, lacking tax residency does not preclude your purchasing real estate. You can buy residential and commercial property (except for agricultural land) even if you’ve never visited Georgia in your life. All you need is money, a desire, and:

- A passport

- A notarized power of attorney in the name of your representative (to process the transaction remotely, if you’d like)

- And the rest of the paperwork is done in the process

Prudence choosing an agency

If you want to buy real estate in Georgia online, you’ll need to find a suitable real estate agency and give them power of attorney to physically conduct the transaction. And the more things the agency can handle for you, the easier it’ll be.

PB Services helps you every step of the way:

- We select property for investment based on your budget and personal needs and give you access to an exclusive real estate database

- We organize in-person or remote viewing, co-ordinate everything with the owner, and provide an independent assessment of the value of the property

- We do the due diligence, dig up the history, encumbrances, and get an extract from the Public Register

- We can prepare the power of attorney, a purchase and sale agreement, a lease agreement (if you plan to rent the property), and a bunch of other documents

- We register the transaction at the Justice House, pay the fees, and get the certificate of registration of ownership for you

- We can also manage the facility so all you need to do is receive your passive income

Order package or individual services. Sign up for a free 30-minute consultation for a detailed overview of the real estate market in Georgia and to ask additional questions.

Please note: PB Property’s realtor services will be free of charge for you because the commission in Georgia is always paid by the seller. The only expense you’ll have to cover is the fee for real estate registration at the Justice House – GEL 150-350 depending on how fast you want it processed. Notary services are calculated per transaction, and the final cost will depend on the number and complexity of documents to be certified.

A real estate purchase transaction needn’t take long. After you have chosen a property, the owner usually gives you 2 weeks to transfer the money to his bank account. On the day of payment, the documents are handed over to the Justice House. The online certificate of ownership is processed in 1 to 4 days. You can always check the status of your application on the website of the Georgian Public Registry.

How to pay for your real estate purchase

The official currency of payment in Georgia is the lari (GEL, ₾), but sellers will usually quote prices in dollars. It is often possible to pay for the purchase in any currency. The official dollar exchange rate at the beginning of October 2024 was GEL 2.7. As for how to pay for your real estate purchase remotely:

- The easiest way is to open an account with a Georgian bank: TBC, Bank of Georgia, or SOLO. Non-residents can also do this remotely. Then you will just need to transfer money to the owner or developer inside Georgia

- If you do not plan to open an account in Georgia, the universal option is an international SWIFT transfer from your account in a bank outside Georgia not under sanctions

- You could also use PayPal or Wise. The maximum transfer for PayPal is USD 60,000 and USD 1.6 million for Wise.

You could also come to Georgia and pay for the property in person, though the maximum amount you can bring into the country without declaring it is GEL 30,000 (about USD 11,000). Another option open to non-residents in Georgia is a mortgage. The mortgage rate is now about 10% in US dollars.

If you are paying for real estate by wire transfer, additional documentation may be required to prove the source of the funds.

Can I buy property with cryptocurrency?

We have already written in a separate blog article about how cryptocurrency in Georgia is just gathering steam, though it is a legal instrument for barter exchange (i.e., you can exchange tokens for an apartment) in spite of transactions not being taxed and the market’s decentralized nature.

In general, buying real estate with cryptocurrency is similar to using fiat money, with the difference that your coins will need to be converted. You may lose some on commissions, though you could also find a developer who accepts payments directly in cryptocurrency (not unrealistic at all).

Bitcoin (BTC), Ethereum (ETH), and Tether (USDT) stablecoins are popular in Georgia just like everywhere else, and many developers also accept other altcoins.

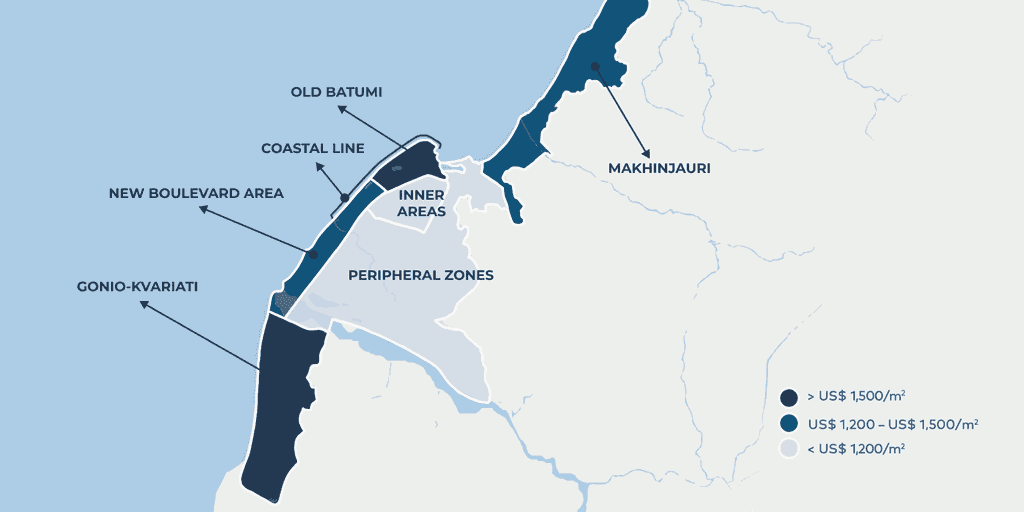

The price of real estate in different Georgian cities

Real estate generally costs less in Georgia than in Europe, the Middle East, or Asia. You can still pick up something new in Georgia’s third largest city (Kutaisi) for USD 25,000. According to investment bank Galt & Taggart, the average cost of a square meter in the country’s two largest cities, Tbilisi and Batumi, in September 2024 was USD 2,000, though a nice apartment in a central district can cost USD 3,500 or as much as USD 5,000.

For example:

- In Batumi’s Boulevard Point, 300 meters from the sea, a 55 square meter two-bedroom apartment will set you back USD 45,000

- A comparable apartment in Tbilisi’s Saburtalo district clocks in at USD 145,000

Property tax

There is no tax on the purchase of real estate in Georgia without reference to the value of the object – this is an important advantage, though the future may hold certain tax consequences, specified in Articles 81 and 202 of the Tax Code of Georgia:

- Income tax on property rentals is 5%

- Income tax on the sale of residential property is 5% and 20% for commercial real estate owned for less than two years. Income on property owned for more than two years is not taxable.

- Property tax is paid annually regardless of residency. If your annual income is between GEL 40,000 and 100,000 (USD 15,000-37,000), you pay 0.05 to 0.2% of the market value. If you make more than GEL 100,000, you pay 0.8 to 1%. If your household income is less than GEL 40,000, you are exempt from property tax.

The advantages of owning real estate in Georgia

Buy a house or apartment in Georgia to enter a fast-growing, dynamic real estate market. According to TBC Capital, the average cost of a new apartment in Tbilisi has increased by 15.4% in the last year alone, for an annual rental yield of 9.8% in dollars.

And owning real estate opens up even more advantages, like the chance to get a residence permit.

Buying one or more properties worth more than USD 100,000 can get you a one-year short-term residence permit and property worth more than USD 300,000 a five-year investment permit with the possibility of permanent residence. Almost 23,000 people availed themselves of this golden opportunity between 2014 and 2023.

PB Property can help you get a short-term or long-term residence permit for real estate for you and your family members to enjoy even more tax benefits, simplify banking procedures, and do business more easily. Sign up for a free 30-minute consultation or leave a request form for more information